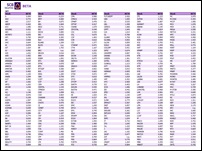

Moving up but limited by next week’s market movers

|

|

Market today

|

| The SET is expected to rise upon positive sentiment from the US and EU markets, which shrugged off the ECB’s 50bps raise in interest rate. However, the SET is seen to have resistance between 1,550-1,560 as next week there are several market-moving items: the US 2Q22 GDP report - which is expected to continue to contract from 1Q22 - and the FOMC meeting, where another rate hike is expected. |

|

|

|

|

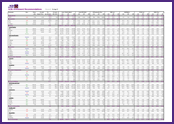

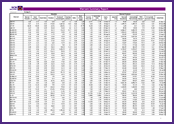

Company analysis

|

|

BBL

– 2Q22: Beat on NII but missed on provisions – Outperform

|

|

KBANK

– 2Q22: Miss on one-off loss – Outperform

|

|

KTB

– 2Q22: Beat on NII and lower effective tax rate – Outperform

|

|

KTC

– 2Q22: Slight beat on better NII, less provisions – Underperform

|

|

OSP

– Expect 2Q22F to fall both YoY and QoQ – Downgrade to Neutral

|

|

SPALI

– Expect 2Q22 net profit to drop YoY but rise QoQ – Neutral

|

| |

FOLLOW US

SCB's Facbook INVX's Twitter