Limited upside and weak on concerns over a rapid rate raise by the Fed

|

|

Market outlook & strategy

|

| The SET is seen to have limited upside at ~1,700 after the previous rebound but it lacks supporting factors sufficient to outweigh the negative factors. The SET is likely to weaken, pressured by concerns over the statement by Powell of a half percentage point rise. Supports are at 1,680 and 1,670 and it will be bearish if it falls lower. We suggest a “Selective Buy” strategy of selecting good-quality defensive stocks with positive drivers to reduce portfolio volatility. |

|

|

|

|

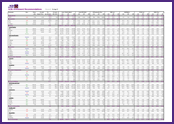

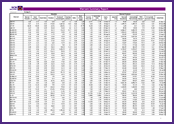

Company analysis

|

|

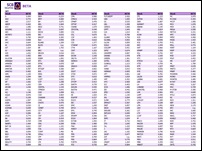

BBL

– 1Q22: Slight miss on non-recurring gains – Outperform

|

|

BJC

– Expect first YoY growth in 1Q22 in two years – Outperform

|

|

KBANK

– 1Q22: In line – Outperform

|

|

KTB

– 1Q22: Beat on provisions and one-off gain – Outperform

|

| |

| |

| |

FOLLOW US

SCB's Facbook INVX's Twitter