To recover further as investment mood improves

|

|

Market outlook & strategy

|

| The SET is expected to recover further as investment mood eased once investors had absorbed the FOMC meeting statement; the focus is now on the meeting minutes, which will be released in mid-Feb, for details of the rate hike and quantitative tightening. We assign resistances at 1,660 and 1,670, with the support zone at 1,630-1,640. Tactically, we suggest buy selectively or speculate cautiously. For the core portfolio, we recommend taking the sidelines. |

|

|

|

|

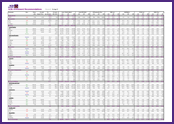

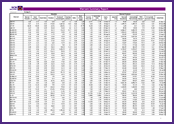

SCBS data book

|

|

SCBS Data book

– A look back at Jan and ahead to Feb |

| |

|

Company analysis

|

|

AH

– Preview 4Q21: Improving earnings – Outperform

|

|

ASP

– 4Q21: In line; attractive dividend yield – Outperform

|

|

GGC

– Preview 4Q21: better profit QoQ priced in – Neutral

|

|

SAT

– Preview 4Q21: Dragged down by extra expense – Underperform

|

| |

| |

| |

FOLLOW US

SCB's Facbook INVX's Twitter