|

November 2024

|

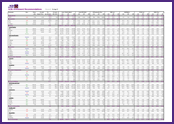

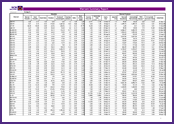

A look back at Oct and ahead to Nov - In Nov the SET is expected to begin recovering after consolidating since the second half of Oct. We expect volatility in early Nov until after the US presidential election (Nov 5). However, support levels are seen at 1435-1440 and 1420, which are expected to hold and facilitate recovery. The influx of funds from both the Vayupak Fund and tax-savings funds towards the end of the year will boost the market. Resistance levels are projected at 1480 and 1500. |

|

October 2024

|

A look back at Sep and ahead to Oct - The SET is expected to experience some consolidation periods in October to cool off after a sharp rally in September. However, the overall trend of the market will be upward, supported by: 1) interest rate cuts by central banks, 2) government stimulus measures and 3) inflows from the Vayupak Fund and ThaiESG, which are expected to provide stability to the market. We assign support levels at 1440 and 1425-1430, resistance levels at 1490 and 1500. |

|

September 2024

|

A look back at Aug and ahead to Sep - The SET is expected to continue to move up in September, supported by both external and internal factors: 1) the Fed's interest rate cut at the September meeting will lead domestic interest rates down, 2) the new government's economic stimulus measures and 3) positive sentiment from the Thai ESG and the Vayupak fund. These are expected to drive fund flows into the Thai market after a lengthy underperformance to other markets. We assign resistances at 1,380 and 1,400, supports at 1,350 and 1,335, which should withstand a cooldown pullback. |

|

August 2024

|

A look back at July and ahead to August - SET upside is expected to be limited at resistances of 1335 and 1345 in August as there are no new catalysts amid a low economic growth environment. This month, eyes must be on key political developments, including the Constitutional Court's ruling on the dissolution of the Move Forward Party on August 7 and the verdict on the PM's qualifications on August 14. Support is assigned at 1290. A break below support would signal a negative shift, with next supports at 1280 and 1270. |

|

July 2024

|

A look back at June and ahead to July - Recovery in the SET in July seems iffy despite the steady fall since late May. We are cautious in view of the absence of strong market drivers and lingering uncertainties surrounding various factors: domestic politics, the Bt10,000 digital wallet, the revival of the Vayupak Fund for capital market support and the timing of the Fed’s cut in policy interest rate. The steady outflow of foreign funds limits upside at resistances of 1,320 and 1,335; supports are assigned at 1,280 and 1,260.

|

|

June 2024

|

A look back at May and ahead to June - The SET faces downside risks in June and may continue the downward trend that began in late May. Key pressure points: 1) technical indicators suggest caution in major global stock markets, including the US and Europe, following a sustained period of growth; 2) domestic political concerns; 3) continued monetary policy uncertainties, with the Fed expected to maintain interest rates while the ECB is anticipated to cut rates in June. We assign market support levels at 1330 and 1300 and resistance levels at 1,360 and 1,380.

|

|

May 2024

|

A look back at Apr and ahead to May - In May, SET movement is limited, with resistances at 1380-1400, and we suggest staying wary for downside. There are several pressures generating a ‘Sell in May’ scenario: 1) low economic growth; 2) monetary policy risk on a slower cut in policy rate by the Fed; 3) political factors, especially tensions in the Middle East; 4) many XDs posting. We assign support at 1330 and 1300. The market needs to push through 1411 to confirm a break in the downward trend.

|

|

April 2024

|

A look back at Mar and ahead to Apr - In Apr, SET upside seems limited at resistance at 1390-1400 as it lacks support and may be pressured by fund outflow if the BoT’s MPCs decided to cut policy interest rate when it meets on Apr 10. Foreign stock markets are likely to pull back or consolidate after a surge in March, which will sour the SET’s mood. We assign support at March’s low of 1350 and expect it to fall below that with the next supports at 1330 and 1300. On the other hand, if it can break through resistance of 1400, we see higher short-term upside with the next resistance at 1435-1445.

|

|

March 2024

|

A look back at Feb and ahead to Mar - In March, SET movement is expected to be limited at resistance of ~1390-1410 due to lack of positive factors and expected sell-on-fact post earnings season and XD. The uncertainty surrounding the timing of the Fed's interest rate cuts will also weigh on market sentiment. On the downside, the market has support at 1350-1360, with risk of falling further to 1330 and 1300. |

|

February 2024

|

A look back at Jan and ahead to Feb - Market upside is limited in February, with resistance levels at 1,390-1,410, due to the lack of any real drivers. Negatives include uncertainty regarding the Fed’s timeline for interest rate cuts following strong US economic data and the gloomy outlook for 4Q23 earnings as these are reported. These suggest downside risk for a new low. The lower bound support is put at 1,330 and 1,300. |

|

January 2024

|

A look back at Dec and ahead to Jan - The SET is expected to cool in January with some slowing. We assign supports at 1400 and 1380. It is expected to continue to recovery, driven by anticipation of a rate cut at the March FOMC meeting. A close above 1,400 is a positive technical signal. Resistances are assigned at 1430 and 1450.. |

| |

|

| |

|

FOLLOW US

SCB's Facbook INVX's Twitter