Sawasdee – March 29, 2022

Window dressing supporting in short-term but upside is limited |

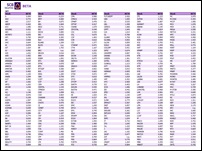

||||

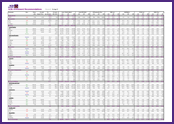

| Market outlook & strategy | ||||

| Although the SET appears stable, investors should be aware of the impact of high inflation that is leading many central banks to speed up their policy interest rate hikes. Investors should keep an eye on the narrowing 10Y-2Y bond yield spread. A negative spread is a sign of economic recession. Profit-taking is expected after window-dressing ends. We assign resistances at 1,688 and 1,695 and supports at 1,670-1,675. Tactically, select stocks with growth and less impact from external factors. | ||||

|

|

||||

|

||||

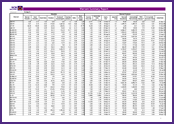

| Company analysis | ||||

| BJC – Five-year growth plan – Outperform | ||||

|

|

||||

FOLLOW US

SCB's Facbook INVX's Twitter