|

28/12/2021

|

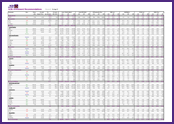

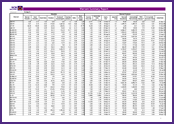

SCB Flash – Exports in November continued to expand at an accelerated pace from the previous month with supporting factors from recovering global consumption and manufacturing conditions, weakening Thai baht, and higher commodity prices.

|

|

25/11/2021

|

SCB Flash – Exports in October continued to surge, though at a slowing rate from the previous month as outbreaks resumed in Europe, while supply disruption heightened inflation. Such conditions weakened consumer purchasing power in various countries

|

|

15/11/2021

|

SCB Flash – Thai Q3/2021 GDP shrank by -0.3%YOY following the global COVID-19 outbreak including Thailand. Various economic sectors were hampered, especially private consumption

|

|

12/11/2021

|

SCB Flash – EIC expects MPC to hold policy rate at 0.5% throughout 2021 and 2022 given better economic recovery outlook, while there is no pressure for rate hike to ensure price stability like other central banks

|

|

01/11/2021

|

SCB Flash – Exports in September recovered from the past two months following better global COVID-19 conditions. However, surging inflation from heightening energy prices will continue to undermine exports in the periods ahead |

|

15/10/2021

|

SCB Outlook - EIC Outlook Quarter 3/2021 |

|

07/10/2021

|

SCB Note – Thailand’s household debt to GDP ratio stood at 89.3% in Q2/2021, slowed down yet remained high. EIC views the high household debt would be a perennial problem, and the low-income earners are facing with a huge burden |

|

29/09/2021

|

SCB Flash – EIC expects the MPC to keep policy rate at 0.5% throughout 2021 and 2022 to support the slow economic recovery with smaller chance of another cut in the short run thanks to the easing of the lockdown and significant progress of vaccination |

|

27/09/2021

|

SCB Flash – Exports in August slowed considerably from the previous month due to plunging gold exports and the global COVID-19 outbreak that weakened the global economy and prompted supply chain disruption in various countries |

|

23/08/2021

|

SCB Flash – July year-on-year export growth soared due to the low-base effect. However, the growth momentum started to stall from the previous month due to the casualties from COVID-19 that weakened trading partner’s demand and suppressed supply |

|

16/08/2021

|

SCB Flash – Thai Q2/2021 GDP accelerated by 7.5% from the low-base effect in addition to the strong merchandise export recovery and government stimulus. However, domestic private demand entered a recession following a 2 consecutive quarters contraction ...

|

|

05/08/2021

|

SCB Flash

– EIC sees higher chance of a policy rate cut this year after the MPC voted to hold the rate in split vote

|

|

23/07/2021

|

SCB Flash

– Exports accelerated in June following increasing global trade momentum and the low-base effect. Going forward, exports should continue to expand, though surmounting risks warrant monitoring

|

|

08/07/2021

|

SCB Note – Thailand's household debt surged to a historic high in Q1/2021. Looking ahead, EIC expects the Thai economy to face a 'Debt Overhang' problem, which could slow recovery in household spending |

|

24/06/2021

|

SCB Flash – Exports surged in May on low-base effect. EIC anticipates continual export growth momentum. However, effects from the latest COVID-19 outbreak in many countries, particularly ASEAN, warrant monitoring

|

|

23/06/2021

|

SCB Flash –

The BOT’s MPC signaled a slower and uneven economic recovery due to the third-wave outbreak. EIC expects inflation to stay within target and the BOT’s MPC to keep policy rate steady at 0.5% through this year and next year

|

|

16/06/2021

|

SCB Outlook - EIC Outlook Quarter 2/2021 |

|

25/05/2021

|

SCB Flash – Exports in April continued to bolster. Despite support from the low-base effect, signs of sound and distributed recovery continued to emerge. Thus, EIC revises up the 2021 export forecast to 13-15%

|

|

17/05/2021

|

SCB Flash – Thai Q1/2021 GDP shrank by -2.6%, improving from the previous quarter following strong merchandise export recovery. However, private consumption returned to a contraction from the second wave COVID-19 outbreak in Thailand

|

|

05/05/2021

|

SCB Flash – EIC expects MPC to keep policy rate on hold through 2021 despite the Thai economy slowing down further from the third wave of the COVID-19 outbreak

|

|

29/04/2021

|

SCB Flash – Promising export recovery in March following better global economic conditions. In 2021, EIC anticipates a higher-than-expected export growth within the range of 7-9%, up from the previous estimation of 6.4%

|

|

09/04/2021

|

SCB Outlook - EIC Outlook Quarter 1/2021

|

|

25/03/2021

|

SCB Flash – Exports (excluding gold) in February 2021 recovered as anticipated, marking a 3 consecutive months growth. Going forward, exports should continue to improve in line with global economic conditions

|

|

24/03/2021

|

SCB Flash – EIC expects a steady policy rate at 0.5% throughout 2021, but sees a possibility of additional government bond purchase by the BOT if financial conditions continue to tighten

|

|

04/03/2021

|

SCB Note –

EIC’s Outlook on the US New Stimulus and its Implication on Economic and Financial Conditions

|

|

23/02/2021

|

SCB Flash – EIC anticipates robust export recovery. In 2021, export growth should expand in the range of 6-8%, increasing from the previous forecast of 4%

|

|

15/02/2021

|

SCB Flash – Thai Q4/20 GDP saw a lower-than-expected contractiondue to improving private consumption conditions following government stimulus boost, in addition to export and inventory growth

|

|

03/02/2021

|

SCB Flash –

EIC expects a steady policy rate at 0.5% throughout 2021

|

|

27/01/2021

|

SCB Note – EIC cuts Thai economic forecast for 2021 to 2.2% as the COVID-19 outbreak resurfaced in various countries, including Thailand

|

|

22/01/2021

|

SCB Flash – Export growth better-than-expected in December 2020. However, amid the second wave of COVID-19 infections, exports could fall below previously forecasted levels in 2021

|

|

11/01/2021

|

SCB Outlook - EIC Outlook Quarter

4

/2020

|

|

06/01/2021

|

SCB Flash

– Exports fell by a slower rate of -3.6%YOY in November from the support of the low-base effect in the prior year |

| |

|

| |

|

FOLLOW US

SCB's Facbook INVX's Twitter