To continue slipping on worries about a COVID surge and rate hikes

|

|

Market outlook & strategy

|

|

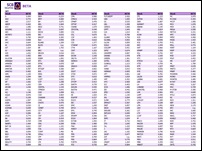

The SET is expected to continue to go down, with its next supports at 1,670 and 1,660 with multiple concerns: 1) a surge in the number of COVID-19 cases after the long Songkran holiday, 2) tightening monetary policy by central banks to control inflation and 3) slowing earnings and economic indicators in 1Q22 on higher energy costs. We suggest a “Selective Buy” strategy of selecting good-quality defensive stocks with positive drivers to reduce portfolio volatility.

|

|

|

|

|

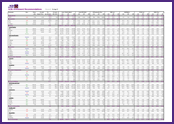

Industry analysis

|

|

Finance

– Preview of 1Q22F: Most up QoQ but down YoY |

| |

|

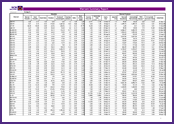

Company analysis

|

|

CPALL

– Revived 1Q22F core earnings – Outperform

|

|

| |

| |

| |

FOLLOW US

SCB's Facbook INVX's Twitter