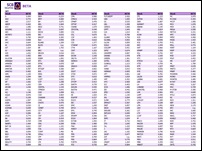

Rebound but upside limited, follow US inflation

|

|

Market today

|

| We expect the SET to continue to rebound, though the lack of supporting factors limits upside, with a resistance range of 1,630 and 1,640; it continues to battle negatives including a slow economy and high inflation. Key factor is US April inflation report to be released in the US on Thursday, key to the Fed’s decision whether or not to raise interest rate. The SET’s short-term support range is 1,612 and 1,600, and it will drop if it falls below that. |

|

|

|

|

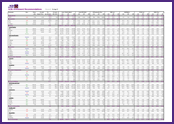

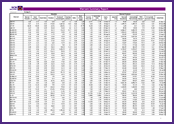

Industry analysis

|

|

Petrochemicals

– Slower market continues to depress spread

|

| |

|

Company analysis

|

|

ADVANC

– 1Q22: In line with consensus –

Outperform |

|

AP

– 1Q22: Earnings at a record high –

Outperform |

|

BJC

– 1Q22: Slightly above estimates – Outperform

|

|

GGC

– 1Q22: Profit good, as expected – Neutral

|

|

IRPC

– 1Q22: Weak profit was in line – Neutral

|

|

MAKRO

– 1Q22: Below estimates on Lotus’s operation – Outperform

|

|

MTC

– 1Q22: Beat on less provisions despite NPLs up – Outperform

|

|

SPALI

– 1Q22: Net profit misses estimates – Neutral

|

|

THREL

– 1Q22: Beat on below-usual combined ratio – Neutral

|

| |

| |

FOLLOW US

SCB's Facbook INVX's Twitter